How Roof Age Affects Insurance Coverage

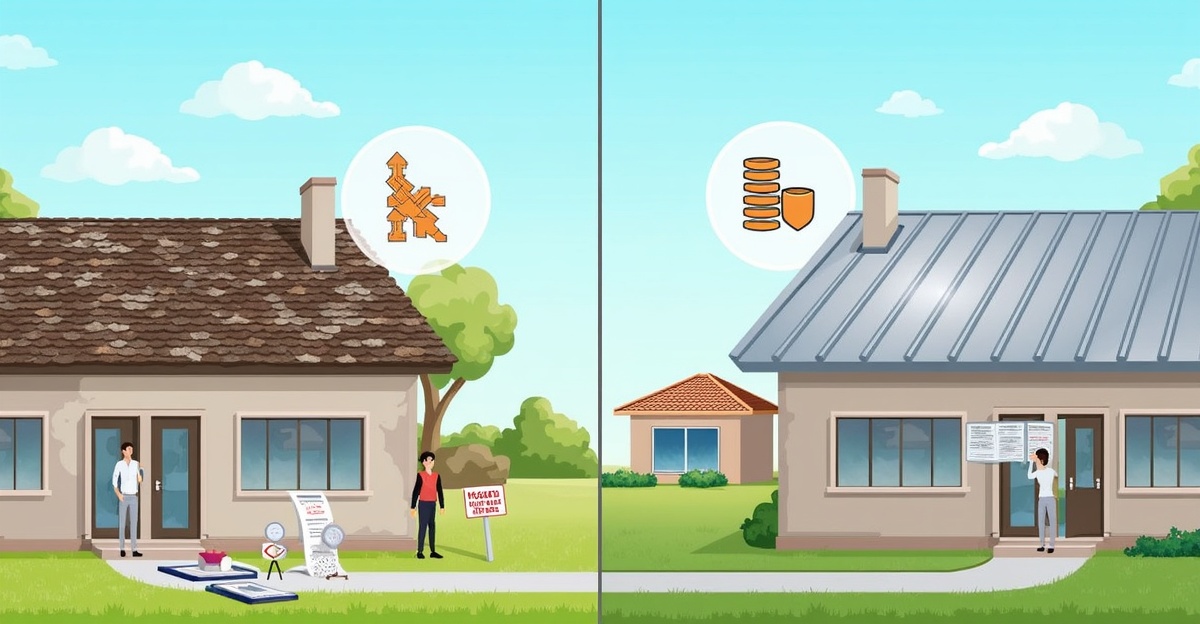

An older roof can raise your premiums, shrink payouts, or even lead to policy cancellation. That’s why roof age plays a key role in your insurance coverage. Many carriers shift coverage from full replacement to actual cash value once a roof hits a certain age—usually 15–20 years for homes and 10–15 years for commercial buildings.

Key Takeaways

- Insurers often reduce coverage to actual cash value after 15–20 years, especially with asphalt shingles.

- Aging roofs may trigger inspections, higher premiums, or non-renewal notices.

- Material matters—metal and tile roofs maintain their value longer than asphalt or flat roofs.

- Age isn’t everything. Carriers assess visible wear and check for proper documentation. Missing records can jeopardize a claim.

- Stay ahead with regular inspections, repair logs, and scheduled upkeep. These steps help protect your policy and cut long-term costs.

What Insurance Companies Look For in Roof Age

Insurance providers treat roof age as a key risk factor. The older your roof gets, the more likely it is to cause or fail to prevent damage. That risk shapes how insurance coverage is offered—or not offered at all.

Most companies set age thresholds. For many residential roofs, 15–20 years is the cutoff for full replacement coverage. After that point, insurers may only pay the actual cash value (ACV) on a claim instead of the replacement cost value (RCV). That means they subtract depreciation before issuing your payout.

So if your 18-year-old roof suffers storm damage and you’re on an ACV policy, your claim check could come up short of the funds needed to replace it. On the other hand, RCV coverage pays for a full replacement, minus your deductible.

Each insurer sets different criteria based on region, weather trends, and risk tolerance. It’s important to know that flat or low-slope commercial roofs often face even tighter coverage limits. In many cases, anything older than 10–15 years may require documented maintenance or reports to stay eligible for full coverage.

We always recommend checking your policy and speaking with your insurance provider. Ask directly about age-based shifts in coverage and how your specific roof type factors in.

How Roof Age Affects Claims, Premiums, and Coverage

Your roof’s age doesn’t just influence the size of a payout—it affects how much you pay and whether you’ll be covered at all.

As a roof gets older, insurance companies often raise premiums or attach inspection requirements. An aging roof might also be flagged as a condition for non-renewal. That’s more common in regions hit by hail, hurricanes, or heavy snow.

If you file a claim and your roof is well past a covered age limit, your provider could deny it—especially if regular upkeep isn’t documented. This is especially true for asphalt shingle roofs. After year 15, insurers tend to switch older roofs to actual cash value to reduce their exposure.

On the commercial side, roof depreciation becomes a major liability. Older commercial roofs can lower asset value, spike insurability costs, and trigger coverage limits. Maintenance records and inspection reports become vital.

Need help understanding the claims side? Our step-by-step guide on how to file a roof insurance claim breaks it down cleanly.

How Your Roof Type and Material Play a Role

Roof type matters just as much as roof age. Insurance companies base policy terms on how long a material usually lasts—and how well it holds up under stress.

How lifespan affects insurance risk

Insurers often adjust premiums or coverage limits based on the roofing material:

- Asphalt Shingles: Last around 15–25 years. Coverage often shifts after 20 years unless condition is confirmed.

- Metal Roofs: Typically last 40–70 years. Good for long-term coverage if you can prove solid maintenance.

- Tile Roofs (Clay or Concrete): Can exceed 50 years. As long as there are no cracks or underlayment issues, insurers may offer full protection longer.

- Flat Roofs (TPO, EPDM, Modified Bitumen): Usually reviewed more aggressively after 10–15 years due to drainage problems or membrane wear.

If you’re not sure about your current roof type and lifespan, our article on asphalt shingle lifespan gives a clear breakdown with signs to watch for.

Signs Your Roof Could Impact Your Insurance

Insurers don’t just consider age—they evaluate what the roof looks like today.

Curling or cracking shingles, bald spots from missing granules, or moss growth are red flags. So are visible sagging, water stains inside your attic, or repeated patches over the same spot. These may lead to non-renewal or reduced payouts if ignored.

For flat commercial roofs, warning signs include standing water, shrinking or separating membranes, damaged flashing, or torn patches.

Missing paperwork doesn’t help either. If you don’t have a record showing roof age or repairs, a claims adjuster could assume the worst.

Documentation matters. Regular photos, dated inspection reports, and repair invoices help keep your coverage intact. Schedule a full inspection once your roof hits the 15-year mark—earlier if you live in a high-risk zone.

Need a guide to spot trouble early? Our article on signs you need a new roof covers what insurance companies look for during evaluations.

What You Can Do to Stay Covered (and Save Money)

There’s a lot you can do to protect your policy—and your wallet.

Take these practical steps to stay insured

- Book a roof inspection before year 15. Do it earlier in storm-prone areas.

- Keep every invoice and inspection write-up. Scan and save them.

- Replace old shingles before insurers downgrade coverage.

- Ask your provider about your roof’s age limits and current depreciation status.

- For businesses, keep a maintenance log and schedule multi-site reviews yearly.

- Bundle minor upgrades where possible—like replacing worn gutters or outdated flashing. They help reduce risk in the eyes of an underwriter.

Want help getting started? Download our “Roof Age & Insurance Coverage Prep Guide” to check off each step before your next renewal.

For quick insight on system age expectations, here’s our post on how long roofs last, based on materials and maintenance levels.

How RayPro Can Help You Plan Ahead

At RayPro, we don’t wait until a leak forces your hand. We help you get ahead of roof age insurance problems before they shrink your coverage—or your claim check.

We offer detailed roof inspections for homeowners and commercial property managers. We focus on what’s important to your insurer: material condition, documentation, and expected replacement timing.

We also don’t sugarcoat timelines. If your roof’s close to being flagged or downgraded, we’ll let you know—then help you prepare. That includes quotes for a full roof replacement or, if applicable, targeted roof repair work that helps extend useful life.

Commercial clients benefit from our asset-wide planning services. We review each building’s roof and provide clear reports for insurance evaluation. If a storm damage repair or inspection is due, we’ll handle that too.

Want to know if your roof risks higher premiums or limited payouts? Jump over to how to tell if your roof needs replacement for straightforward advice.

Let’s talk about where your roof stands today. Schedule a no-pressure inspection with RayPro Roofing and get real answers before your next policy renewal.

We’ll make sure your next insurance review doesn’t come with surprises.